Share capital growth in Casablanca

The share capital of a company is the amount of equity contributed to the company by the partners/shareholders. This sum can only be reimbursed to partners/shareholders under certain conditions. It must therefore remain in society and can be used for its needs. It represents the pledge of partners/shareholders towards third parties.

In the life of a company, it may prove necessary to carry out a capital increase for the following reasons:

- The company’s equity is below the legal thresholds (1/4 of the share capital)

- The company needs to take out credits or cash lines from banks or investors. The latter request capital increases as additional guarantee

- The company wishes to work with certain clients who require a minimum amount of share capital as collateral

- Integration of a new partner through new contributions and following a company evaluation

- ……

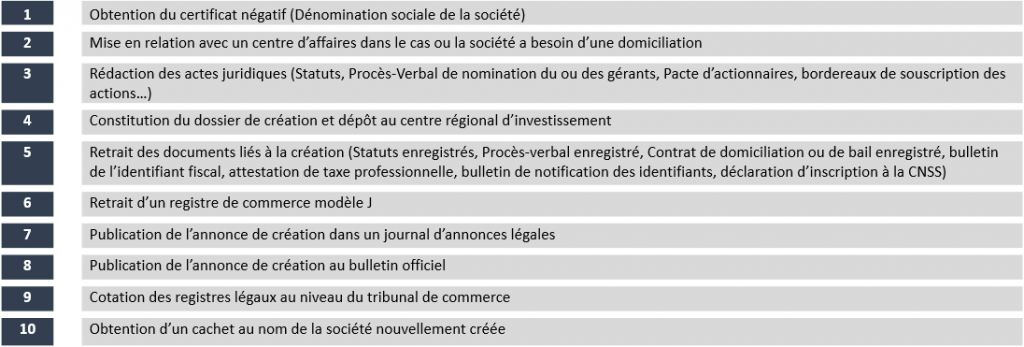

As an accounting firm, our firm takes care of all capital increase formalities in Casablanca. The capital increase formalities in Casablanca mainly include the following work:

- Convocation of partners to the general meeting

- Drafting the text of the resolutions to be presented to the meeting

- Drafting of the manager’s report to the general meeting ruling on the capital increase operation

- Drafting of the minutes of the General meeting deciding on the capital increase

- Modification of original article of association

- Registration of Legal documents at the Tax services

- Filing of Legal documents at the commercial court of Casablanca or other city

- Withdrawal of the commercial register Certificate with the new information

- Publication of the details of the operation in a Legal notice newspaper

- Publication of the details of the operation in the official bulletin

The time required to complete a capital increase operation in Casablanca is around 2 to 3 weeks.

In the context of increases in share capital by offsetting a liquid and payable debt on the company, the accountant has sole authority to certify the amount of the debt subject to offsetting by issuing a certificate.

The same applies to operations involving the contribution of movable or immovable property to the company in return for the issue of new shares and which require the report of the contribution auditor in Casablanca. The most commonly carried out operations are the contributions of equity securities to a holding company or the contributions of real estate to a company.